Calculating annualised earnings

All candidates living in Queensland will need to provide their annualised earnings in their Registration of Interest (ROI) to be considered for selection.

What are ROI annualised earnings?

ROI Annualised earnings show what you would earn over a full year based on your actual income so far.

It may be different from your annual salary on your employment contract, especially if you’ve only worked part of the year or had variable hours – and that’s fine. With all candidates using the same method for calculating their ROI annualised earnings, everyone will be treated equally.

How do I calculate my ROI annualised earnings?

There are two methods for calculating your ROI annualised earnings, depending on whether you are an employee (paid by payslips and have an ATO Income statement) or self-employed (you invoice clients to receive your income).

Please follow the instructions below to calculate your ROI annualised earnings for your situation so your application may be considered.

Calculating your annualised earnings – employee

We have adopted a simple method to help you calculate your annualised earnings based on your Australian Taxation Office (ATO) Income Statement.

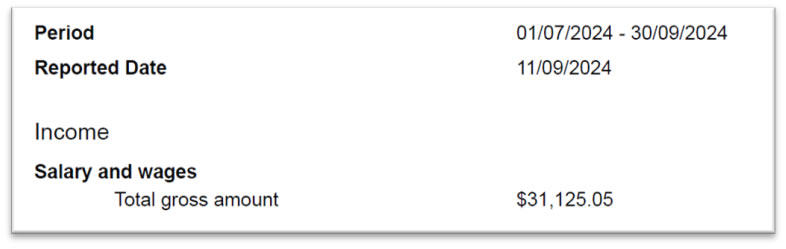

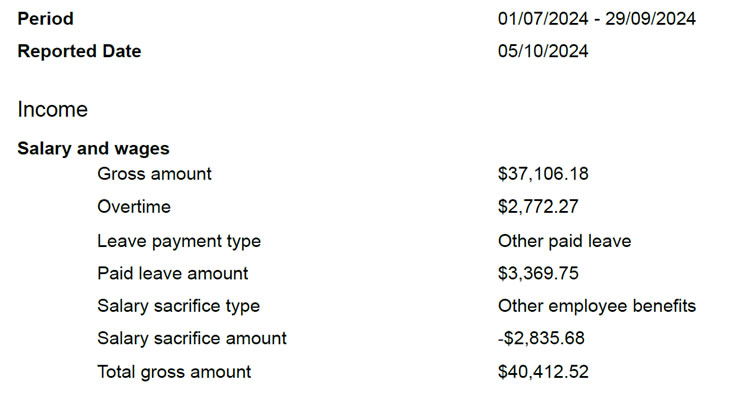

From your Income Statement, you will need:

- Period start date

- Period end date

- Salary and wages total gross amount.

To calculate your ROI annualised earnings:

- Divide the total gross amount by the number of days in period (the number of days in period is the number of calendar days between the period start date and the period end date, inclusive)

- Multiply by 365.

Example 1

- Number of days in period = 30/09/2024 – 1/07/2024 = 92 days (inclusive of first and last date)

- ROI annualised earnings = ($31,125 / 92) * 365 = $123,485

Example 2

- Number of days in period = 29/09/2024 – 1/07/2024 = 91 days (inclusive of first and last date)

- ROI annualised earnings = ($40,412 / 91) * 365 = $162,092

- ROI annualised earnings can include all payment amounts included on your ATO Income statement. This includes overtime and paid leave. Be sure to use the total gross amount from your statement for your calculation.

Important information

If you are currently working for multiple employers, you can repeat this calculation for each Income Statement and combine the total earnings for your ROI submission.

You can only include employment that is closely related to your nominated occupation. If you work a casual job that is not related to your nominated occupation (e.g., food delivery), you cannot include these earnings in your annualised earnings calculation.

Please make sure you are currently employed by, and actively working at, an employer to include those earnings in your annualised earnings calculation. Do not include earnings for employment you have already finished.

Your ATO Income Statement period must cover at least 28 days to be eligible. If you have not worked for your current employer for a period of at least 28 days, or do not yet have an ATO Income Statement that covers 28 days, you must wait to submit your ROI.

Please save a copy/ies of your ATO Income Statement/s used to calculate your annualised earnings and provide them as evidence with your ROI. Please note you cannot return to the ATO website at the time of invitation and download a copy of your Income Statement from the time you submitted your ROI.

If you cannot provide your ATO Income Statement/s when you submit your ROI, your application will be refused.

The Reported Date on your ATO Income Statement/s must be within a month of submitting your ROI.

Where can I find my Income Statement?

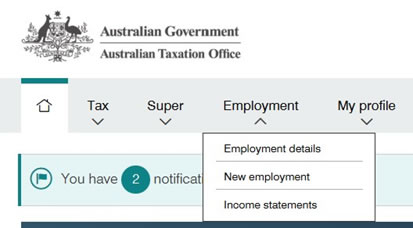

1. Access ATO online services by logging into myGov or the ATO app.

2. Under the Employment tab, select Income statements.

3. Under the Current tab, find your Income Statement/s for the current financial year.

4. Click on the down arrow next to your current employer’s name.

5. At the bottom of page, select Print friendly version and save your Income Statement as a PDF to include in your application.

Calculating your annualised earnings – self-employed

Use this method to calculate your ROI annualised earnings if you are self-employed and invoice clients to receive your income. The income must be for work that is closely related to your nominated occupation.

If you are contracted to work for another business under an Australian Business Number (ABN), the contracting business might still pay you like an employee and issue you with payslips. If you receive payslips for your income, please use the ATO Income Statement method instead.

Estimate your ROI annualised earnings from the gross profit reported in the profit and loss statement for your business.

To estimate your ROI annualised earnings, use the calculation:

Gross profit ÷ Days covered by statement × 365 days

= ROI annualised earnings

Term definitions

Gross profit: This is a standard line item on a profit and loss statement. It is the difference between the sales made by your business and the direct cost of making the sales (e.g. cost of goods sold).

- If your business does not have any direct costs to making sales, gross profit is simply your business sales.

- Your statement may use a different term for gross profit. If you are unsure which line item to use, please check first with your accountant.

Days covered by statement: This is the number of calendar days covered by your profit and loss statement.

For example, a profit and loss statement “For the 6 months ending June 2025” covers the 181 calendar days from 01 January 2025 to 30 June 2025.

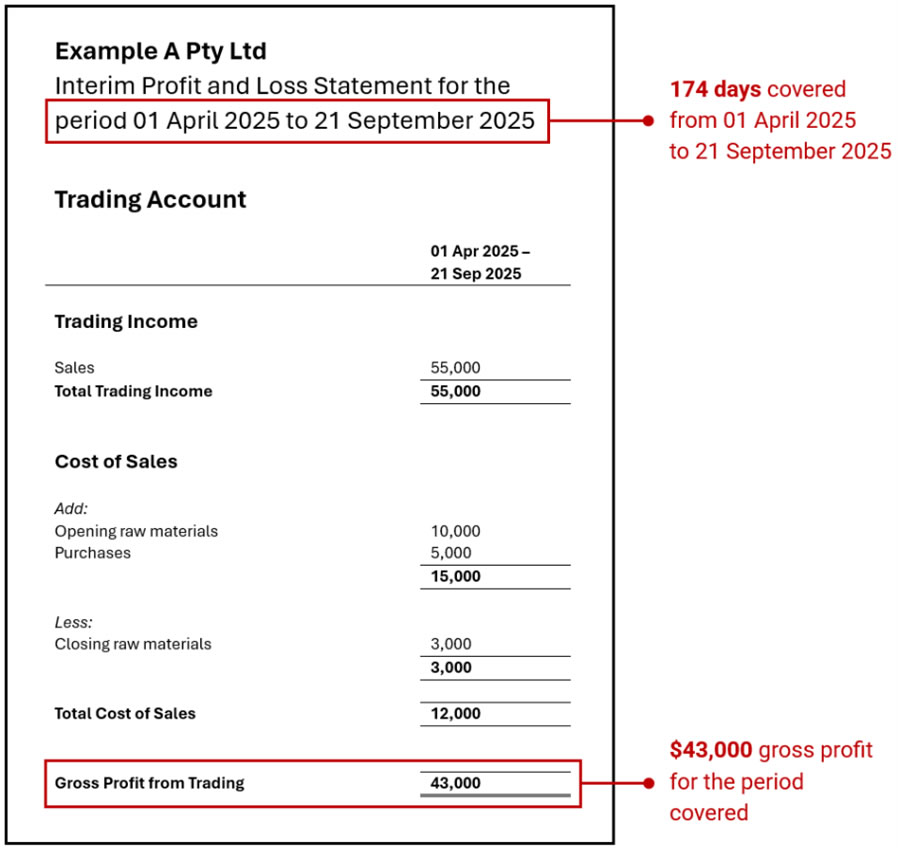

Example A

$43,000 gross profit ÷ 174 days covered by statement × 365 days = $90,201 estimated for ROI annualised earnings

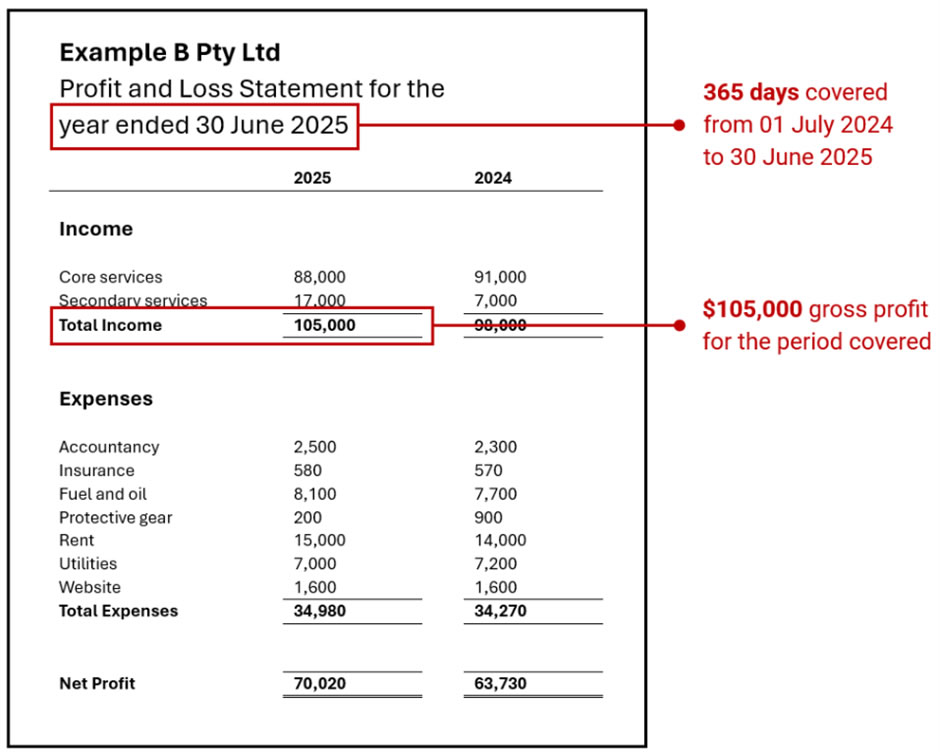

Example B

Since the business does not list any direct costs to making sales, the gross profit is simply the sales of the business, under total income.

$105,000 gross profit ÷ 365 days covered by statement × 365 days = $105,000 estimated for ROI annualised earnings

Important information

Requirements for the profit and loss statement:

- Produced and signed by a registered accountant.

- Covers a period of at least 3 months for up to 1 year. If you have not yet operated your business for a period of 3 months, or don’t yet have a profit and loss statement for 3 months, you must wait to submit your ROI.

- The profit and loss statement end date is within 3 months of submitting your ROI. For example, if you submit your ROI on 27 September 2025, you can use a statement that ends 30 June 2025. But if you submit your ROI on 5 October 2025 you will need a new profit and loss statement.

- You have owned and operated your business for the entire period it covers.